Tax Planning and Advisory

Tax Planning and Advisory Tax Accounting, Preparation and Planning Our tax advisors have extensive expertise in tax accounting, preparation and planning. This expertise places us in a unique position to partner with you at all phases of your business and personal journey. We will help you achieve your best results by developing a comprehensive strategy…

Read MoreHaven’t filed your 2019 business tax return yet? There may be ways to chip away at your bill

The extended federal income tax deadline is coming up fast. As you know, the IRS postponed until July 15 the payment and filing deadlines that otherwise would have fallen on or after April 1, 2020, and before July 15. Retroactive COVID-19 business relief The Coronavirus Aid, Relief and Economic Security (CARES) Act, which passed earlier…

Read MoreSmall Businesses: It may not be too late to cut your 2019 taxes

Don’t let the holiday rush keep you from taking some important steps to reduce your 2019 tax liability. You still have time to execute a few strategies, including: Buying assets. Thinking about purchasing new or used heavy vehicles, heavy equipment, machinery or office equipment in the new year? Buy it and place it in service…

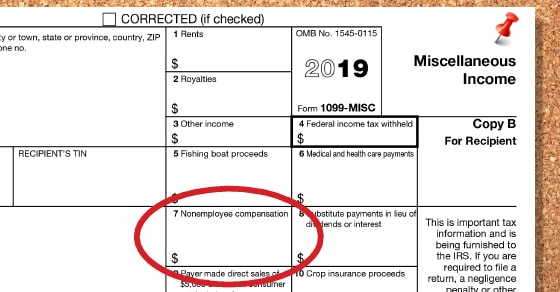

Read MoreSmall businesses: Get ready for your 1099-MISC reporting requirements

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time consuming and…

Read MoreSmall businesses: Stay clear of a severe payroll tax penalty

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time. If you willfully fail to do so, you could personally be hit with the…

Read MoreJohnathan G. Orrock,

Biography Johnathan is the Tax Partner for WellsColeman. Johnathan has over 20 years of experience and specializes in advising small to medium-sized businesses with a focus in many industries including construction and manufacturing. Johnathan has extensive expertise in business and individual income tax planning and preparation. Johnathan is passionate about helping his clients define and…

Read MoreRyan Kirtner,

Biography Ryan is a Partner with a focus on tax planning, preparation and advisory. Her experience includes complex tax accounting for business formation, business succession, and mergers and acquisitions. She specializes in corporate, partnership, and high net worth individual taxation. Her passions include anticipating the needs of clients while developing long-term solutions to complex tax…

Read More