Taxes

2019 Business Planning Guide

All businesses seek to reduce costs, and year-end tax planning presents the opportunity for significant savings that affect your bottom line. The Tax Cuts and Jobs Act of 2017 created a myriad of challenges for businesses of all types. But along with the challenges are opportunities for businesses to leverage timely tax strategies to lower their…

Read More2019 Individual Planning Guide

With the end of the year approaching, you should consider strategies that might help reduce your 2019 tax bill. Last year was the first year impacted by the Tax Cuts and Job Act of 2017(TCJA). Even though there were no significant legislation changes in 2019 affecting individual taxes, situations vary from year to year, requiring a…

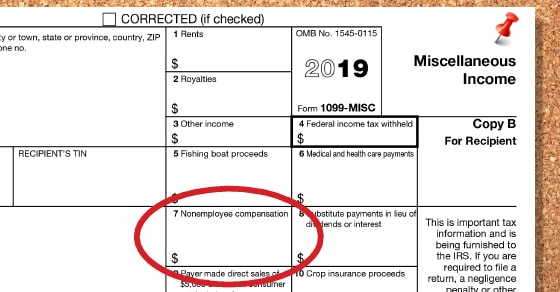

Read MoreSmall businesses: Get ready for your 1099-MISC reporting requirements

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time consuming and…

Read MoreSmall businesses: Stay clear of a severe payroll tax penalty

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time. If you willfully fail to do so, you could personally be hit with the…

Read MoreBeware the Ides of March — if you own a pass-through entity

Shakespeare’s words don’t apply just to Julius Caesar; they also apply to calendar-year partnerships, S corporations and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes. Why? The Ides of March, more commonly known as March 15, is the federal income tax filing deadline for these “pass-through” entities. Not-so-ancient history Until…

Read MoreVirginia Governor Signs Tax Conformity Legislation

Virginia Governor Ralph Northam signed legislation today to conform Virginia’s tax laws to the Federal Tax Cuts and Job Act. The Virginia Department of Taxation can now begin processing 2018 individual income tax returns. Additional information can be found at www.tax.virginia.gov. Contact us today if you have questions about this or other tax legislation.

Read MoreDepreciation-related breaks on business real estate: What you need to know when you file your 2018 return

Commercial buildings and improvements generally are depreciated over 39 years, which essentially means you can deduct a portion of the cost every year over the depreciation period. (Land isn’t depreciable.) But special tax breaks that allow deductions to be taken more quickly are available for certain real estate investments. Some of these were enhanced by…

Read MoreMany tax-related limits affecting businesses increase for 2019

A variety of tax-related limits affecting businesses are annually indexed for inflation, and many have gone up for 2019. Here’s a look at some that may affect you and your business. Deductions Section 179 expensing: Limit: $1.02 million (up from $1 million) Phaseout: $2.55 million (up from $2.5 million) Income-based phase-ins for certain limits on…

Read MoreYear-End Reporting Reminder for Businesses

Form1099-MISC S-Corporation Health Insurance Personal Use of Employer-Provided Vehicle It is more important than ever to make sure you are meeting your reporting obligations. If you need assistance with these important year-end reminders, please contact your partner. Form 1099-MISC: Whether you prepare Forms 1099-MISC yourself or request WellsColeman to prepare them for you, there…

Read More