Taxes

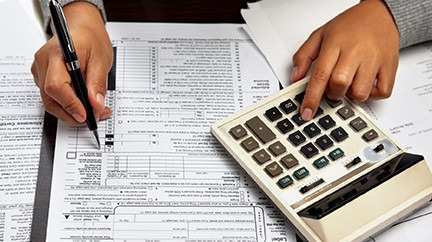

Year-End Planning for Businesses

Business tax planning is very complex. Careful planning involves more than just focusing on lowering taxes for the current and future years. How each potential tax saving opportunity affects the entire business must also be considered. In addition, planning for closely-held entities requires a delicate balance between planning for the business and planning for its…

Read MoreYear-End Planning for Individuals

On December 22, 2017, President Trump signed sweeping federal tax reform into law, which significantly changed the U.S. tax system for both individuals and businesses. The changes under the new tax law are extensive and complex. They may also provide opportunities for additional tax savings. In order to maximize these savings, we will need to…

Read MoreCongratulations to George

Notable Mentions Congratulations to our managing partner, George Forsythe, who was quoted in the AICPA article When Friends Want Free Accounting Help. This article notes the value of providing free advice or services to certain situations and warns of what needs to be considered before agreeing to help, as well as, discusses how to be…

Read MoreSpring 2017 – Alliance Newsletter

[document file=”https://wellscoleman.com/wp-content/uploads/2017/05/BDO-Alliance-NL-Spring-2017.pdf” width=”600″ height=”400″]

Read MoreVirginia Tax

New electronic payment requirement for some individual income taxpayers The 2017 Budget Bill includes a new requirement for certain tax payments. Effective for taxable years beginning on or after Jan. 1, 2017, taxpayers who make estimated tax payments must submit all of their income tax payments electronically if: • Any installment payment of estimated taxes…

Read MoreVideo Series

WellsColeman kicks off Friday Feature video series on CPA Secrets to a Better Business. (Week 1) Friday Feature: This week’s theme is Acquiring Financing. Are you making the right decisions when it comes to seeking financing? Check out our latest video in the series to learn more. Acquiring Financing – Series Video #1 (Week 2)…

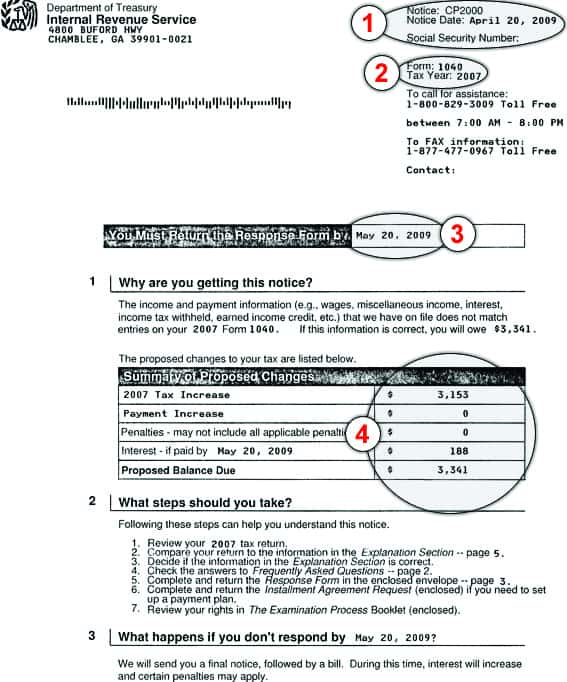

Read MoreIRS Warns about Fake Tax Notice Scam

IRS Warns Taxpayers and Practitioners of Fraudulent CP2000 Notices In a recent news release, the IRS alerted taxpayers and tax pracitioners to an email scam involving fraudulent CP2000 notices for the 2015 tax year. The notices, which are attached to the email and appear to be issued from an Austin, Texas address, relate to the…

Read MoreYear-End Tax Planning

Upcoming Changes to Filing Deadlines and New Overtime Provisions Beginning January 1, 2017, several new filing deadlines will go into effect. The IRS’s goal of these new deadlines is to create a more logical flow of information and help you file more accurate and timely returns. Avoid missing deadlines by making a note of the dates that…

Read MoreChanges Affecting Qualified Retirement Plans

Changes Affecting Qualified Retirement Plans With the Internal Revenue Service’s recent release of final regulations on Roth distributions, it might be a good time to summarize the several changes that have been made either through legislation, IRS action, or court decisions affecting qualified retirement plans over the last year or so. Designating Disbursements — In Notice…

Read More